Children’s National Renews at 1730 West Street in Downtown Annapolis

Annapolis, MD – February 25, 2026 – Children’s National renewed its lease at 1730 West Street, reaffirming its role as the anchor medical tenant at this Class A medical office property in Downtown Annapolis. The property sits along West Street near Luminis Health Anne Arundel Medical Center. It offers strong visibility, direct access to Route 50 and I-97, and ample surface parking for patients and staff. Its location and layout make it a leading outpatient medical destination in the Annapolis

93.5 WRNR Annapolis, MD pumps up the volume with a new FM signal!!

Legendary rocker ‘WRNR’ (WYRE-A / W228ER), which returned to the FM airwaves last July at the 93.5 FM frequency, is pleased to announce their expansion with the addition of W228DI (93.5 FM) Silver Spring, MD. 93.5 FM WRNR will now be heard from the shores of the Chesapeake Bay to the banks of the Potomac River and everywhere in between!! Effective March 1st, Cortona Media LLC will program W228DI (93.5 FM Silver Spring, MD) and the HD4 channel of WTOP-FM via a Lease Management Agreement with Hubbard

Back Nine to Host Grand Opening & Ribbon Cutting in Crofton

Crofton, MD — February 23, 2026 — Back Nine will celebrate the opening of its new Crofton-area location with a Grand Opening and Ribbon Cutting on Saturday, March 7, from 11:00 a.m. to 2:00 p.m., with the ribbon cutting scheduled for 12:00 p.m. The event will take place at 1166 MD Route 3, Suite 207, Gambrills, MD, and will be held in collaboration with the Crofton Chamber of Commerce. Community members, local business owners, and chamber representatives are invited to attend. Back Nine offers a modern

Rise and Shine Bakery Announces Donna Wyatt as Executive Director

Annapolis, MD – 02/01/2026 – Rise and Shine is pleased to announce the promotion of Donna Wyatt as Executive Director of the Rise and Shine Workforce Training Program. “We are pleased that Donna has accepted this new position”, Elizabeth Kinney, Board President of Rise and Shine said. “Over the last two years Donna has demonstrated her outstanding leadership in overseeing programming, case management, job training, job placement and she has the passion and commitment needed to help individuals with

Hyatt Commercial Brings New Tenant to Main Street Retail in Annapolis

ANNAPOLIS, MD – February 17, 2026 – Hyatt Commercial has completed the lease of a retail space at 161 Main Street in Annapolis, one of the city’s most recognizable retail locations, welcoming a new tenant to Main Street. The approximately 3,000 square foot space sits along historic Main Street. It offers a rare opportunity for a retailer to join Annapolis’ established Main Street retail community. The location benefits from strong pedestrian traffic and close proximity to downtown attractions. This new

Augie's Mussel House & Sports Bar Opens in Annapolis, MD

Augie's Mussel House & Sports Bar Opens in Annapolis, MDAnnapolis Town Center Welcomes New Neighborhood Sports Bar with Game Day Atmosphere ANNAPOLIS, MD – February 12, 2026 – Augie's Mussel House & Sports Bar is set to open its doors in late February 2026 at Annapolis Town Center, bringing its signature Belgian-inspired cuisine, extensive beer selection, and vibrant sports bar atmosphere to Maryland's capital city. The new Annapolis location marks an exciting expansion for Augie's, which has built a

Heritage Partners News Release: 2/12/2026

ANNAPOLIS, MD – February 12, 2026 - Heritage Partners, LLC is pleased to announce that Warren “Bud” Duckett, III, Esq. has received his Maryland real estate broker’s license, further strengthening the company’s commercial brokerage capabilities throughout the region. As General Counsel of Heritage Partners, Bud has been actively involved in commercial real estate advisory, leasing, and transactional strategy. Obtaining his broker’s license marks an important professional milestone and reflects his

Hyatt Commercial Brokers Office Investment Building in Annapolis

ANNAPOLIS, MD – February 11, 2026 – Hyatt Commercial announces the sale of an Office Investment Building in Annapolis located at 31 Old Solomons Island Road. The property sold for $1,250,000, with the transaction closing on January 30, 2026. Hyatt Commercial represented the seller, Annapolis Investment Associates, in the transaction. The firm’s investment sales team— Owen Wellschlager, Cecil Cummins, and Eric Pinkett— facilitated the sale on behalf of the seller. Meanwhile, the buyer, Even Keel

Press Release: LifeBloom One-Month Fundraiser

LifeBloom One-Month Fundraiser | Feb 1 – Mar 2Supporting Women’s Healing, Wholeness, and Wellbeing LifeBloom is a community-centered nonprofit organization dedicated to supporting women dealing with reproductive health issues like Endometriosis, PCOS, Infertility, Fibroid, which leads to emotional, physical, and mental health. Our mission is simple but urgent: To empower women with clarity, confidence, and community around their health -especially fertility, endometriosis, and holistic wellness-through

New Year Renewed Wellness with Inspiration Wellness

At Inspiration Wellness, LLC we deliver personalized therapy plans that produce measurable improvements in mental health, efficiently and compassionately. Serving Annapolis, MD, our licensed clinicians combine evidence-based techniques with client-focused care to help you reach goals faster. Learn how our tailored approach can support your team or patients: www.inspirationwellness.org #MentalHealth #BehavioralHealth #Annapolis

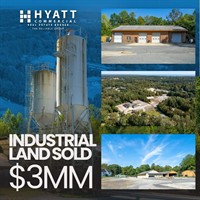

Hyatt Commercial Facilitates $3 Million Sale of Former Concrete Plant on 36.79 Acres

ANNAPOLIS, MD – February 6, 2026 – Hyatt Commercial announced the successful sale of a former concrete plant situated on 36.79 acres, including approximately 12.5 usable acres, zoned I-1 Light Industrial. The property sold for $3,000,000. The site is located within an I-1 Light Industrial District, allowing for a wide range of permitted uses such as light manufacturing, fabricating, processing, distribution, and warehousing. Aggregate-related uses are not permitted. The property includes multiple

Hyatt Commercial Celebrates Recent Team Elevations

ANNAPOLIS, MD – February 3, 2026 – Hyatt Commercial announced recent team elevations at its Annual Sales Team Retreat. These promotions reflect the firm’s continued growth and commitment to developing talent from within. The firm recognized George Shenas, Treva Ghattas, and Collin Mercier for their leadership and contributions. George Shenas has advanced to Senior Vice President. Since joining Hyatt Commercial in 2017, he has focused on retail brokerage services across Central and Southern Maryland and

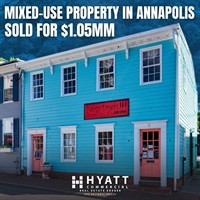

Downtown Annapolis Mixed-Use Property at 6–8 Fleet Street Sold for $1,050,000

ANNAPOLIS, MD – January 29, 2026 – Hyatt Commercial announces the sale of a mixed-use property located at 6–8 Fleet Street in Annapolis. The recently renovated building sold for $1,050,000. John Gallagher and Eddie Trujillo represented the seller in the transaction. The property sits in the heart of Downtown Annapolis, between the Maryland State House and the Annapolis Harbor. The location offers strong visibility, walkability, and multiple income streams. The first floor includes retail space just steps

New Year Renewed Wellness at Inspiration Wellness

New year, renewed wellness. Therapy services to support your growth, healing, and peace of mind. Ready to find a safe, supportive space to work through life’s challenges? We provide personalized therapy sessions—offered both in-person and virtually—so you can receive care in the way that works best for you. Convenient Annapolis, MD location Complimentary 15-minute consultation Flexible scheduling to fit your needsBook your free 15 minute consultation today at www.inspirationwellness.org

Leadership Anne Arundel Opens Nominations for 2026 New Leaders Celebration

ANNAPOLIS, MD (January 14, 2026) – Leadership Anne Arundel (LAA), the premier leadership training and networking institute in Anne Arundel County, has opened its call for nominations to recognize outstanding New Leaders at the 2026 New Leaders Breakfast Celebration, to be held on Wednesday, April 29, 2026, at Carrol’s Creek Café in Annapolis. Nominations must be submitted by Friday, March 13, 2026. Pending receipt and review of all nomination materials, the LAA Executive Committee will select the

Seasonal Wellness Therapy Services at Inspiration Wellness

Ready to find a safe, supportive space to work through life’s challenges? Our licensed therapists are here to guide you with compassion and understanding as you navigate stress, anxiety, relationships, and personal growth. We provide personalized therapy sessions—offered both in-person and virtually—so you can receive care in the way that works best for you. Convenient Annapolis, MD location Complimentary 15-minute consultation Flexible scheduling to fit your needs Your well-being is important. Take

J² Education and Wellness Brings Mobile CPR and Safety Training to Local Businesses and Organizations

J² Education and Wellness, LLC is a locally owned training provider specializing in CPR, AED, and Basic Life Support certification for businesses, organizations, and community partners. J² Education and Wellness delivers mobile, on-site CPR training to help employers ensure staff are prepared to respond when a customer, coworker, or visitor experiences a cardiac or breathing emergency. Having certified staff on site supports workplace safety, compliance requirements, and confidence in emergency

Tips for Incorporating Your Business for Enduring Success

Incorporating your business can be a strategic pivot that transforms mere survival into thriving success. Imagine establishing a foundation that not only safeguards your personal assets but also amplifies your enterprise’s potential to grow and evolve with stability. Whether you’re just starting on your entrepreneurial journey or you’re looking to elevate your thriving business, incorporation offers a suite of advantages that can fortify growth.Turbocharge Growth with Tax-Deferred